About Us

Vericast accelerates financial institution performance through the power of data, technology and people. We help banks and credit unions drive growth, achieve efficiency, improve engagement and navigate change. Our advanced analytics, data-driven insights and integrated solution set enables better execution with agility, precision and scale. That’s why thousands of financial institutions look to Vericast and our 150 years of financial services expertise to help them achieve more.

Years of Financial Services Industry Experience

of US commercial banks and credit unions work with Vericast

Best practices from

FI campaigns annually

$

Invested annually in compliance

Our Story

NEWS

WHAT’S HAPPENING AT VERICAST

Stay up to date with Vericast news and announcements

PRESS RELEASE

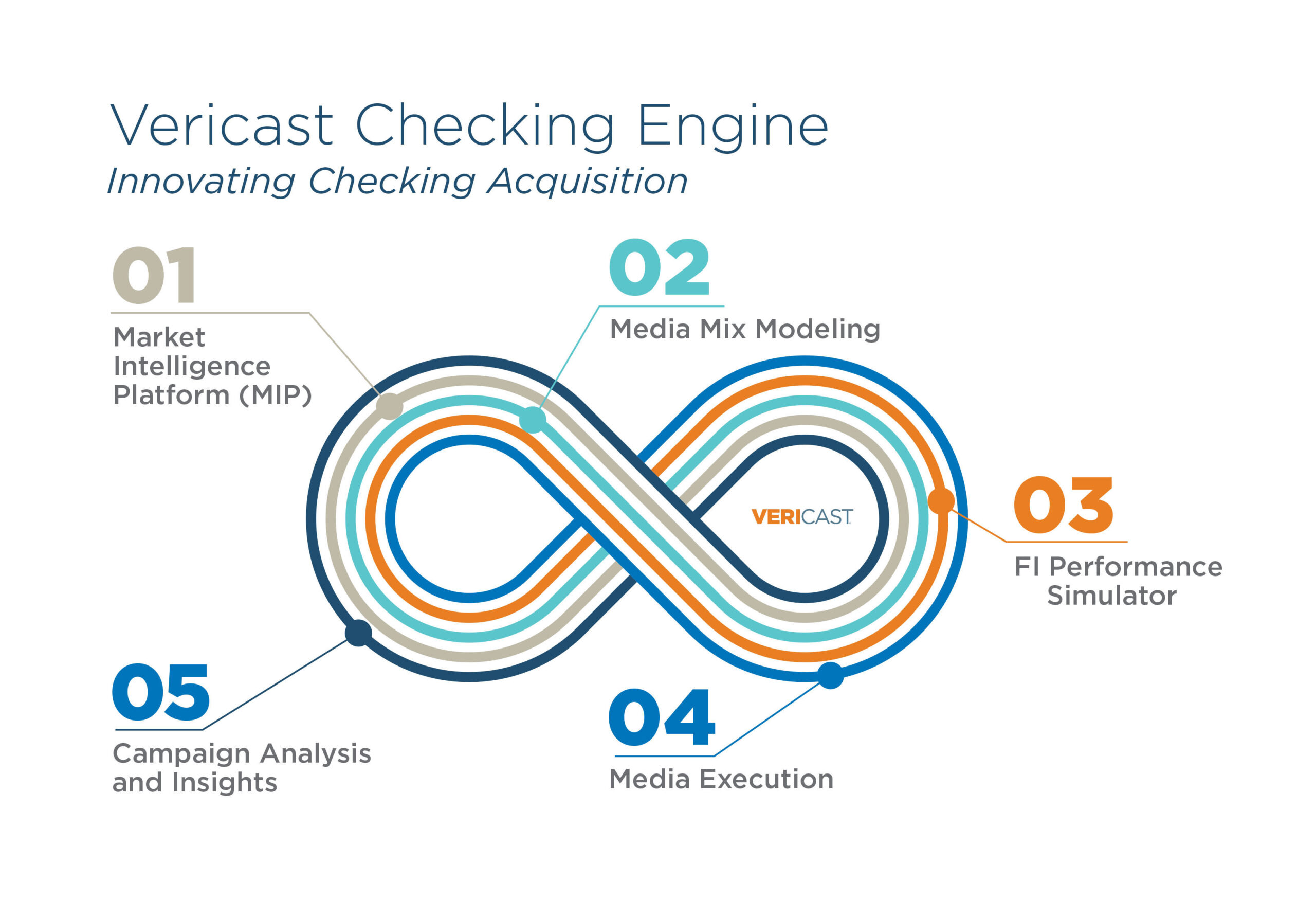

Vericast’s “Checking Engine” an Industry-First Financial Innovation to Drive Acquisition

Learn More

PRESS RELEASE

57% of Consumers Will Stay with Their Bank, Unless Offered Attractive Incentives Elsewhere, Vericast Research Finds

Learn More

COMPANY INFORMATION

Get to know the leaders paving the way for Vericast innovation, insight and growth

Learn More

Serving our people, communities and planet to help shape a better future

Learn More