Rising prices are putting a strain on consumers financially and emotionally. A slowing economy and skyrocketing inflation are eating up their savings as they struggling to pay back loans, fill their tanks, put food on the table, and even purchase everyday essential retail products.

Inflation and related stresses are also putting a strain on banking relationships. Consumers may be willing to throw loyalty out the window if they can switch to a financial institution that offers a better opportunity to maximize their savings.

Making Sense of the Market

To benefit from this trend, financial institution must first increase their competency for understanding the indelibly strong, symbiotic connection between consumer emotion and financial well-being.

Our recent consumer survey revealed three out of four of respondents say the amount of money in their bank account impacts their mental health. And the target of consumers’ frustration and source of their emotional distress is not limited to grocery stores and gas stations, as their top two banking pet peeves are account service fees (31%) and overdraft fees (23%). In tandem, almost eight out of ten (79%) consumers surveyed expect financial institutions to offer flexibility on rates and fees, such as waiving overdraft or late fees

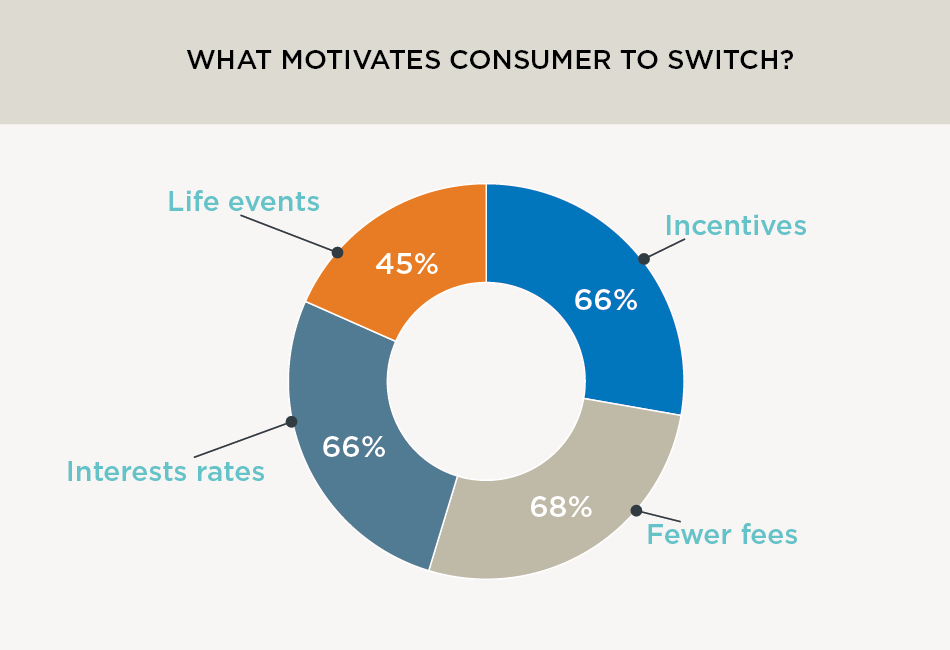

Here’s where it gets really interesting for marketers. When asked what would motivate them consider switching financial institutions:

Breaking Up With Your Bank

Switching financial institutions was once considered cumbersome and inconvenient. Now consumers may be willing to switch for the right reason. Consumers may also consider opening accounts at neobanks, FinTechs, or other online banks with more favorable offers and better rates.

For institutions that employ the right marketing tactics, like targeted omnichannel acquisition marketing campaigns that promote great loan rates, rewards-based checking, high-yield savings offers, and monthly account maintenance and overdraft fee waivers, the sky’s the limit.

Source: Vericast/Dynata Financial Consumer Survey – June 2022, n=1000