During a time when loan rates are high and deposit dollars are at a premium, many banks and credit unions have necessarily had to shift their marketing strategies. To do so, they needed to rely on the power of data. From first-party data to census or other public-record data, the ability to understand and apply data is the key to winning in this environment.

Recently, Vericast commissioned Forrester Consulting to survey marketers on how they have adjusted strategies to attract and retain customers in today’s geopolitical state. After surveying 316 marketers across an array of industries, we found that the 100 financial institution marketers formed a unique subset.

Financial institution marketers cited facing several challenges, including:

The perils of personalization. 58% of respondents said they experienced difficulties developing a personalized advertising experience for their target audience.

Many agree personalization is needed to create more relevant offers and customer engagement to move the needle for success.

Data paralysis. 57% of respondents are also experiencing difficulties making sense of customer data. Not surprisingly in tandem, 55% of respondents are challenged to drive insights from customer data.

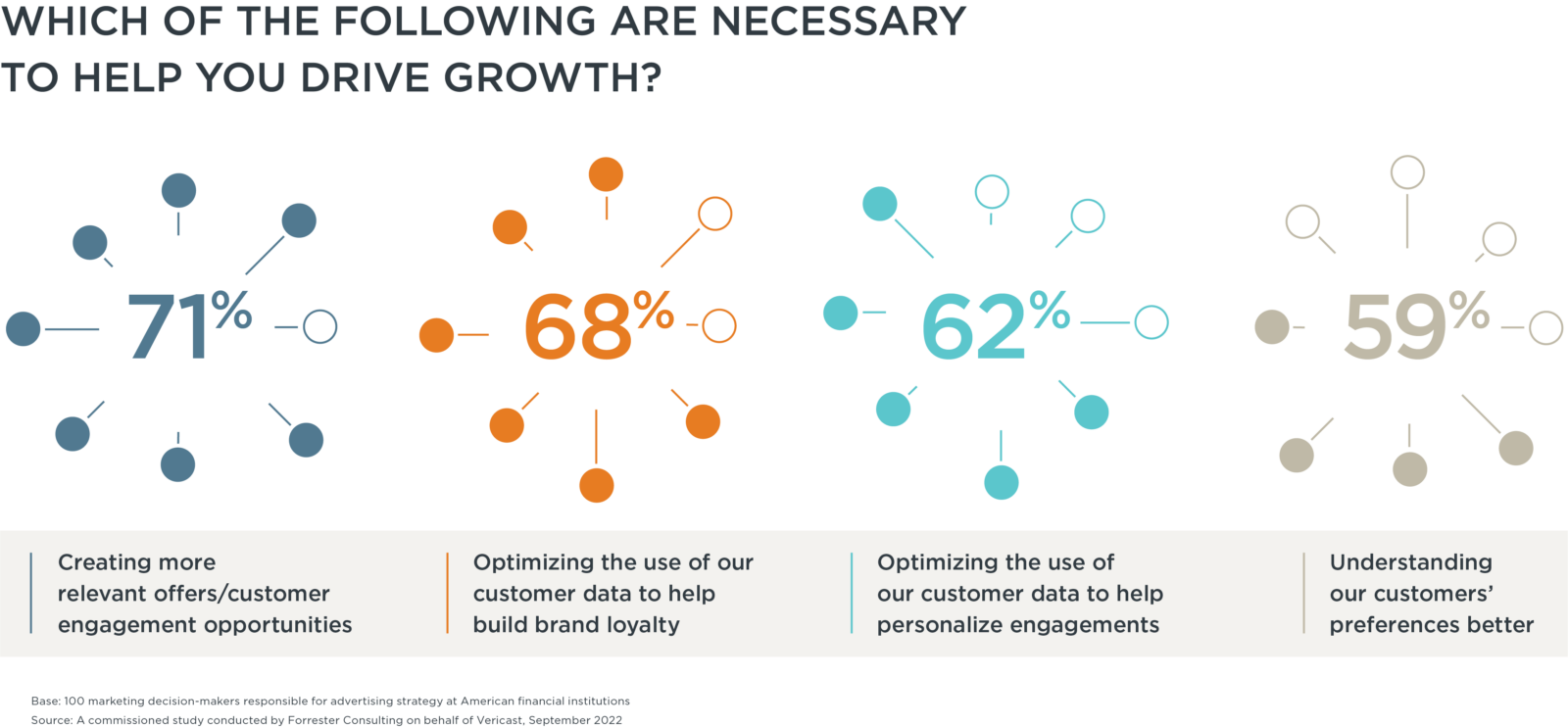

It all comes down to optimizing use of customer data. Respondents ranked four ways it can drive growth:

- Create relevant offers and customer engagement opportunities

- Build brand loyalty

- Understand customer preferences better

- Personalize engagements with customers

How are they overcoming the hurdles?

Respondents were clear that they needed to up their data game to drive success. They are adapting. To combat the instability of the current geopolitical state, respondents are experimenting with new customer-engagement techniques (63%), restructuring goals to be more aligned with the current environment (54%), and changing their target audience (46%). As they rework their advertising strategy, respondents are using agile marketing strategies to account for how the current state of the world is affecting consumer behavior.

- They are changing their messaging. Respondents note a shift in their approaches to customer relationships, with a greater focus on empathetic messaging (54%) and consultative messaging (57%). In addition, over half of the respondents (53%) are placing greater focus on personalization by creating more targeted offers and/or rewards.

- They are prioritizing data optimization. To ensure they continue to grow, even in today’s economic climate, respondents are prioritizing data optimization and evolving their advertising strategy to include the right channel, with the right messaging, at the right time, whether it be email, connected TV (CTV), or display or social ads.

What’s needed to succeed?

By investing in the right data tools, financial institutions can understand their customer preferences better, to create more personalized and relevant ads and to increase the overall success of their marketing function.

Find out more ways to make sense of your customer data to develop personalized experiences download the full Forrester x Vericast report.

Base: 100 marketing decision-makers responsible for advertising strategy at American financial institutions

Source: Reach Your Customers In Today’s Geopolitical State, A commissioned study conducted by Forrester Consulting on behalf of Vericast, September 2022