Customer loyalty is like a good haircut: you don’t appreciate it until it’s gone.

What do we mean by Customer Loyalty?

In this blog, I am determining loyalty based on how long households have been with a primary bank and how those primary connections are growing or shrinking. Let’s compare loyalty as it was in 2022 versus where it sits today. This 2-year gap gives us a chance to understand shifts driven by the economy, rate changes, movement, and migration, as well as household preferences.

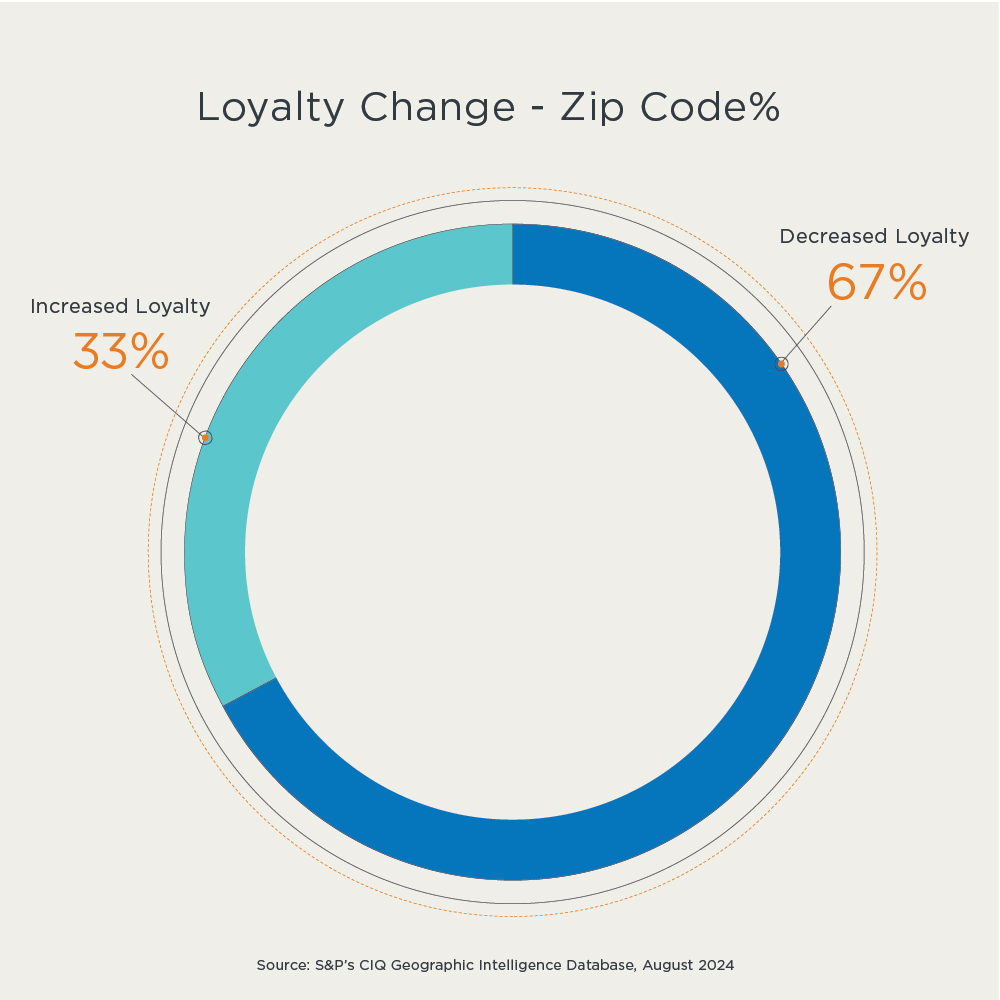

Overall Loyalty

Banking loyalty has long been considered a stable and reliable base upon which banks and their branches could rely. It’s probably time to change that preconception and recognize that assuming clients will stick around simply because they always have is a dangerous proposition. Why?

According to S&P’s CIQ Geographic Intelligence Database, 67% of zip codes have seen declining bank loyalty over the past two years. While some of those changes are small, it becomes more common to lose short and long-term customers than in the past. The fact that we are seeing widespread and consistent loyalty declines points to a system wide change in behavior as opposed to it just being a one-time blip. Much like other industries, COVID forced households to re-examine their spending, changed how companies interact with households (apps, mobile, digital), and spawned innovation that means traditional assumptions are now outdated assumptions.

US Banking Loyalty by State

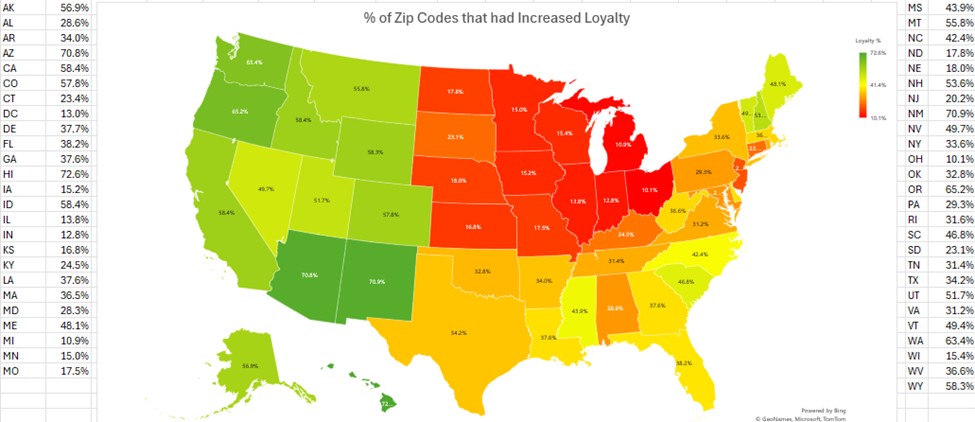

Let’s take a look at the national level. There are some interesting items immediately visible.

Source: S&P’s CIQ Geographic Intelligence Database, August 2024

- The state with the highest loyalty is Hawaii where 72.6% of zip codes saw increased loyalty.

- Only 13 states had more zip codes with loyalty increases over the past two years, which suggest that losing loyalty is now the norm and that fact should be a little eye-opening for financial institutions.

- In Ohio, only 10.1% of zip codes increased their loyalty. 32 states had at least 60% of their zip codes decline in loyalty.

- We are in a place where even best results are at a C minus grade and the vast majority are failing.

Regional loyalty appears to be a real thing in the United States. The top 10 most loyal states sit in the Pacific and Mountain time zones. I have a couple of prevailing theories about this trend concerning where people are moving. While the Pacific states have a large outflow of people, a lot of those same people are moving to different western states (California to Idaho as an example). This means that they are a bit more likely to move somewhere that has branches for the same bank so less of a forced need to change.

Meanwhile, the Midwest and Plains states are essentially a banking free-for-all with 75% of zip codes or more showing loyalty declines. These areas have seen a greater level of movement from outside areas so forced banking changes may be impacting the results. There is also a greater percentage of community-sized banks which increase options.

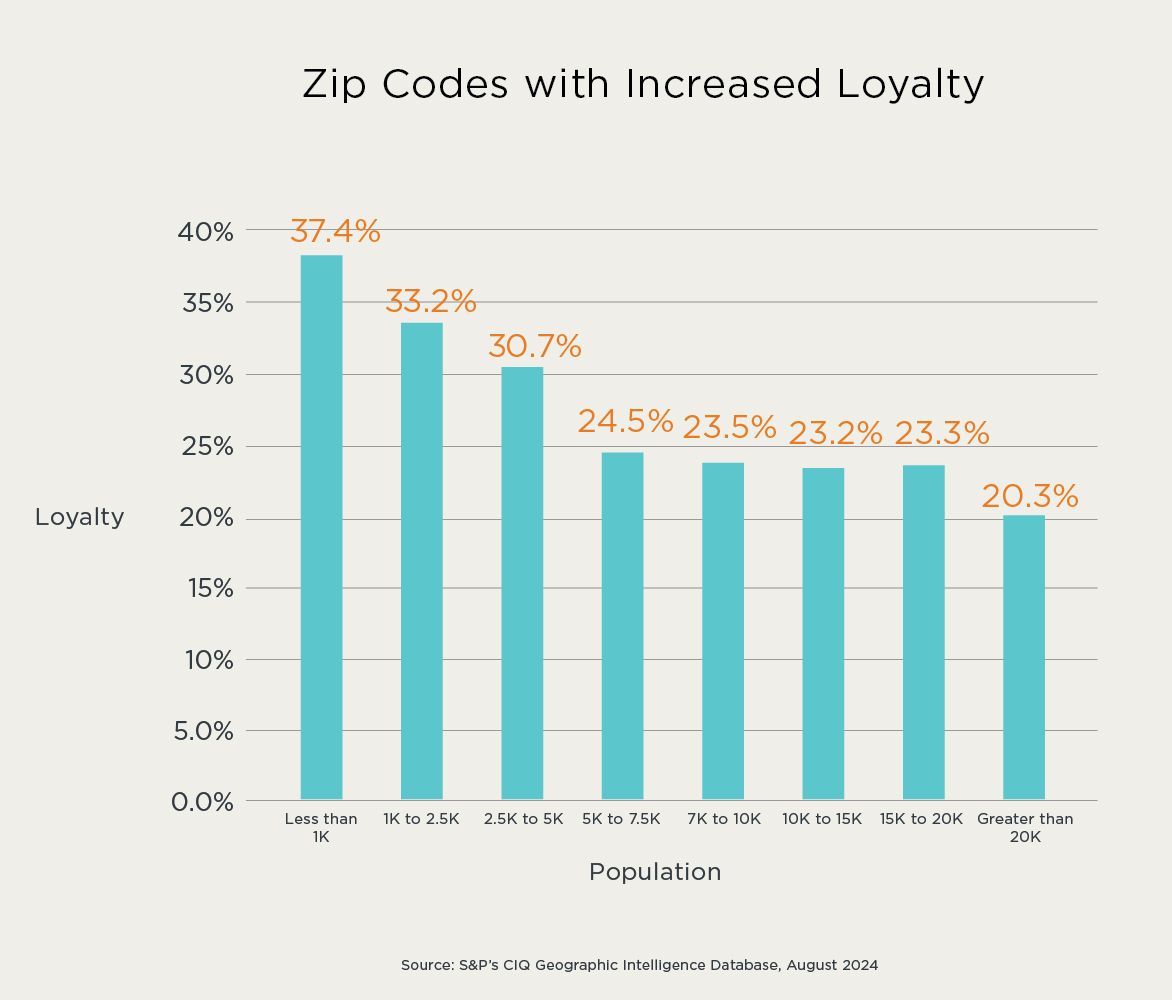

Zip Code Size Matters

Across the US zip codes with fewer than 1000 households, saw 37.4% of their zip codes increase in loyalty. Not a strong number to start with, but it seems great compared to zip codes with 20,000 or more households. Those saw only 20.3% of zip codes increase in loyalty.

This is another strong indicator that there is an active battlefield in the marketplace for the banking customer and embracing that issue is going to be key to retaining households that might look to leave and win new customers to build growth.

Long story short: the larger the zip code, the less likely it is to show loyalty to a bank.

Main Takeaways

Cursed are the financial institutions who think “We’ve always done it this way”, “Stick with what got us here”, or “We don’t need a new way, we understand our area”. This old-fashioned way of thinking will not work in the current environment.

If you’re looking to get an eagle-eye view of your market and capture or recapture deposits, let’s talk. Vericast can help you get and see the details to protect your turf and grow your footprint. We can help push you to the forefront of customers’ minds and grow your balance sheet.

Want to read more? Check out this writeup by Bain and Company, watch our Customer Loyalty webinar, or review our 2024 TrendWatch Report: The Evolution of Banking Loyalty.