In today’s competitive financial landscape, marketing strategies live and breathe by data. The real challenge isn’t the lack of data but effectively harnessing and consolidating it for impactful results.

As the saying goes, “We all start somewhere.” This holds true when crafting a marketing strategy. Banks and credit unions can amplify their success by layering their data with insights from external providers and partners.

5 Key Data Intelligence Categories Every FI Should Be Using

The categories below focus on building intelligence and how to predict the market for financial products.

1. First-Party Financial Institution Insights

Your institution’s first-party data is a solid foundation to start building a targeted advertising strategy. By leveraging customer characteristics, you can optimize marketing investments. Analyze this data to uncover key insights such as product performance by geography, utilization rates, retention trends, and more.

2. Geographic Intelligence

Enhance your first-party data with third-party geographic data to sharpen marketing strategies. Insights into geographic characteristics can help in effectively prioritizing marketing spending and product promotions. By prioritizing, you’ll be able to spend and message effectively, making sure you’re making the most of your opportunities in various geographic areas.

3. Competitive Intelligence

There is magic in numbers. With first-, second- and third-party data, you can gather visibility insights. Competitive intelligence offers visibility insights such as how competitors price products and what search inquiries are popular in various markets. These factors can help you identify untapped opportunities, such as underutilized marketing channels or regions where competitors are less active.

4. Financial Industry Benchmarks

Industry benchmarks provide a lens to evaluate your performance against the broader market. Understanding product penetration rates or market trends can aid in refining your promotional strategies. For instance, benchmarks can reveal whether to promote CDs or money market accounts in specific regions, while helping you set realistic expectations for new market entries.

5. Consumer Predictive Intelligence

Predictive analytics transform vast datasets into actionable insights. By identifying behavioral patterns and correlations, you can refine your audience, determine optimal marketing spend, and enhance campaign performance. This approach not only boosts ROI but also strengthens your institution’s ability to anticipate customer needs.

Why a Unified View of Data Matters

Integrating these data categories into a single, cohesive view simplifies decision-making, and speeds campaign activation. Imagine having a comprehensive dashboard that reveals consumer behavior, geographic product penetration, and competitor activity. A unified perspective provides actionable insights, empowering your institution to make data-driven decisions with confidence.

Data is a Friend, Not a Foe

Data should work for you, not against you. Start by creating a structured learning plan to extract actionable insights. Small, incremental learnings from each marketing campaign compound over time, leading to significant improvements. Focus on uncovering one new insight per campaign to refine your overall strategy without feeling overwhelmed.

Gain a Competitive Edge With Data-Driven Marketing

Acquiring new accounts is challenging for financial institutions. Understanding consumer behavior for account and loan acquisition has never been more important. Influencing these customers requires a strategic approach.

- Vericast’s Market Intelligence Platform provides a visualization dashboard that leverages multiple data sources, artificial intelligence, and advanced identity resolution technology to provide insights in compliance with fair banking laws. MIP provides access to real-time consumer behavior at the household and neighborhood level thanks to more than 140 billion daily data signals across 130 million households.

Vericast’s Market Intelligence Platform layers various data sets including:

- Consumer behavioral data – Actions, preferences, and decision-making processes provide insights needed to develop effective strategies and positive customer experiences.

- Digital marketing insights – Tools and techniques to understand how consumers interact with digital marketing channels, such as as social, email and websites.

- Loan and deposit activity – Critical for identifying opportunities, developing relevant messaging, and optimizing product offerings

- Credit data – Essential for identifying potential customers, assessing risk, and understanding individual customer needs

- Loan application data – Crucial component for understanding customer behavior, assessing needs and tailoring messaging accordingly

- Competitive data – Understand your position in the market, and obtain valuable insights into trends, positioning and marketing tactics.

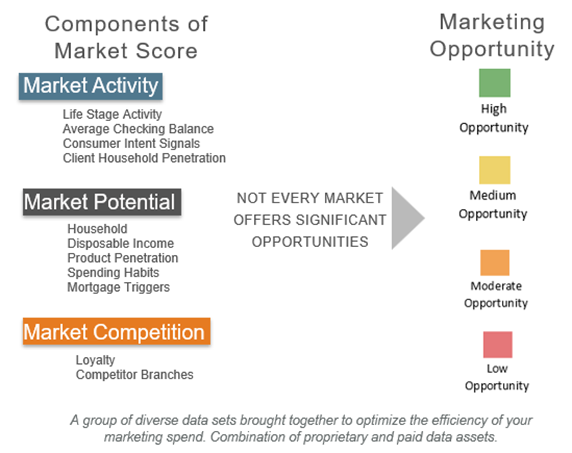

MIP uses a proprietary approach to rank geographies by low, medium and high opportunity. This powerful tool seamlessly integrates multiple data sources compliantly to arrive at an Opportunity Score that identifies the markets and consumers most likely to be receptive to your offers.

Proprietary and external data is filtered by market potential, market activity, and market competition. Attributes are assigned within each, including product and client household penetration, loyalty index by market, deposit growth and move rate, competition, and exclusive consumer intent signals.

By scoring the highest opportunity markets, we’ve seen a 22% average lift across campaigns compared to just focusing on a traditional branch radius.1

When leveraging these critical data insights, financial marketers can thrive in a competitive market. Armed with a deeper understanding of your target audience, you’ll be equipped to tailor products and services to meet customer needs effectively. Remember, every data-driven action you take moves you closer to marketing excellence.

1 Vericast Market Intelligence Platform aggregated campaign analysis of markets with branch presence, 2023