- Fraudsters are targeting the check ordering process, exploiting this traditional payment method that remains viable.

- By integrating advanced fraud prevention methods into the check ordering platform, fraud can be detected and mitigated before it starts.

- Vericast offers a robust response to emerging threats, combining technology and shared intelligence for optimal financial security.

In an era dominated by the steady march toward cashless transactions, the relevance and importance of traditional payment methods like checks cannot be underestimated. They still hold an integral position in our financial landscape – a fact known all too well by fraudsters.

With increasing digitization, check order fraud has emerged as a significant concern. This type of fraud occurs when individuals other than the account holders order checks to be delivered to a different address. The unfortunate reality is that such actions, if not detected quickly and addressed immediately, can cause substantial financial damage.

Innovating Fraud Prevention

Vericast offers a comprehensive solution to stop check fraud before it starts. Using an advanced fraud prevention system integrated into its check ordering platform, Vericast combats check order fraud in real time. This method ensures that secure transactions are the norm, not the exception.

Real-Time Scoring and Assessment

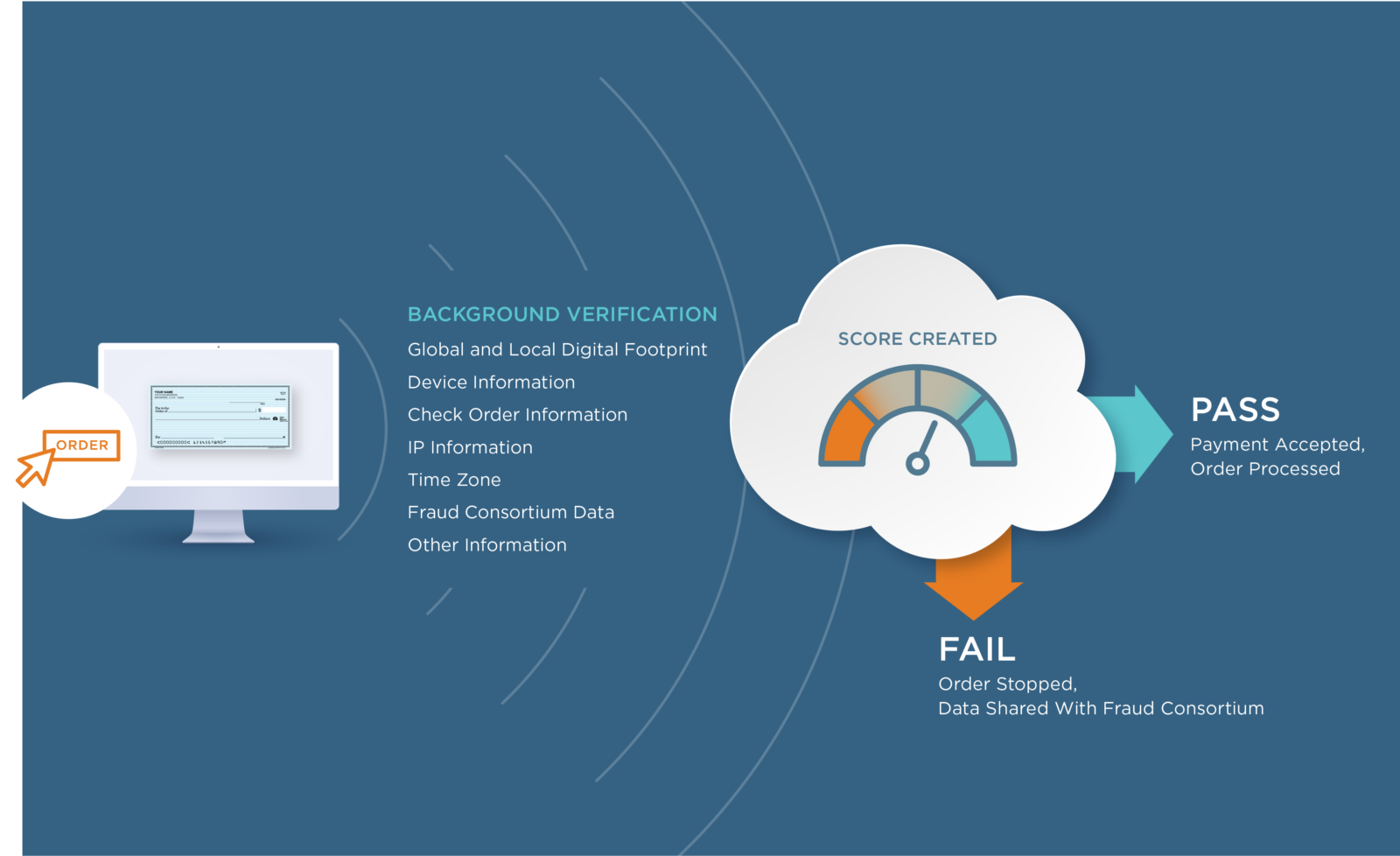

Vericast employs a blend of cutting-edge technology and consortium data to score check order sessions through our direct consumer-facing ordering channel. The scoring process, done in real time, doesn’t require any additional information from the customer that is not already part of the check order process. The system analyzes a variety of data points from the check order session, including email account age, online activity, proxy detection, and more.

Leveraging Digital Identity Assessment

A significant aspect of Vericast’s advanced fraud prevention is the use of digital identity assessment. As a member of a global consortium, Vericast has access to crowdsourced intelligence from numerous sectors. This pooled knowledge allows the system to detect potential fraud attempts, not only from new customers but also from existing account holders who might be trying to alter their shipping locations. The system’s efficiency is further boosted by considering known fraudulent devices across retailers, leading to enhanced accuracy in fraud detection.

Three-Level Fraud Mitigation

This preventative system operates on three distinct levels for maximum efficiency:

Level 1: Device level validation ensures the legitimacy of the device used for placing the check order.

Level 2: Traditional ID verification confirms the accuracy of the customer’s identifying information.

Level 3: Fraud consortium data leverages shared risk data from consortium members, potentially identifying first-time offenders before they commit fraudulent acts.

Streamlining and Ensuring Security

Upon the evaluation of these factors, the system generates a risk score for each order, which determines whether an order passes or fails. The score is derived from over 500 real-time authentications, ensuring that orders are analyzed thoroughly and accurately. For orders that fail, customers are directed to contact their financial institution for further assistance, providing a streamlined, user-friendly process.

Discreet Operation for User Trust

One of the standout features of Vericast’s system is its discreet operation. While it employs complex algorithms and advanced tech in the background, it does not necessitate requesting sensitive customer data for validation purposes. This aspect not only adds a layer of convenience for the user but also builds trust in the system’s operations.

Continuous Improvement for Future-Proofing Fraud Prevention

In addition, Vericast’s system is built on the principle of continuous improvement. When a potential fraudulent order is detected, the information is securely shared within the fraud prevention consortium, fostering a collaborative effort to stay ahead of evolving fraud schemes. This evolving nature of the system ensures its robustness and responsiveness to emerging threats, maintaining optimal fraud prevention measures.

Looking Ahead in Financial Security

Check order fraud is an issue that we must tackle head-on to secure our financial transactions. Vericast’s advanced fraud prevention system exemplifies a potent combination of technology and shared intelligence, working in tandem to deliver a safe, reliable, and user-friendly process.

In a world where the rate of fraud seems to grow as quickly as the pace of technological advancement, solutions like Vericast’s are invaluable tools in protecting our financial security.

Learn more by downloading our brochure, “Stopping Check Order Fraud: Secure Check Order Process with Vericast.”