Financial marketers find themselves in a good news/bad news situation this year. Marketing budgets are on the rise, which suggests that financial institutions clearly are finding value in marketing. But along with that stronger position come increased expectations and scrutiny.

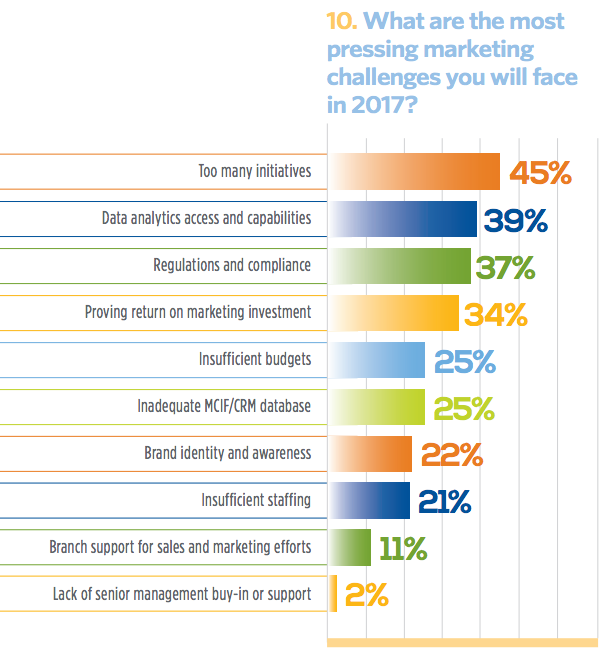

When we asked marketers in our annual survey to identify their most pressing marketing challenges for 2017, the need to meet or exceed past successes came through loud and clear. The top challenge boils down to an increased workload for marketers, as 45 percent of respondents say they’re feeling stretched by too many initiatives.

Following close behind is a concern about having sufficient access to data analytics and whether those analytics are capable of proving their value.

And a whole new level of stress has arisen around regulations and compliance, which have moved into the Top 3 challenges for the first time. This is followed by the need to prove the return on marketing investment, which goes to the heart of marketers’ jobs, day in and day out.

The good news is that sufficient staffing is not the concern it was two years ago, and lack of senior management buy-in has dropped by 5 percentage points, again underscoring the increasing recognition of marketing’s value.

Plus, financial services marketers who can identify and acknowledge the challenges working against them are in a better position to overcome the headwinds that can threaten recent accomplishments. So maybe bad news doesn’t have to be bad after all.

Caution: High Expectations Ahead

This year’s survey revealed increased expectations and workload top the list of challenges for financial services marketers. A need for better data analytics and proving ROMI point to the new “hot seat” marketers find themselves in. What else did this year’s survey reveal? Read the report to find out.

> Download the full report now