Consumers are in control. Give them access to the loan products they need, when they need them.

Higher loan volume, better consumer experiences

Today’s consumers are in control. They expect 24/7 access to information and want to find lending options quickly and conveniently. In the competitive loan environment, you can’t wait for consumers to come to you — you must proactively tell them what’s available and prompt them to act.

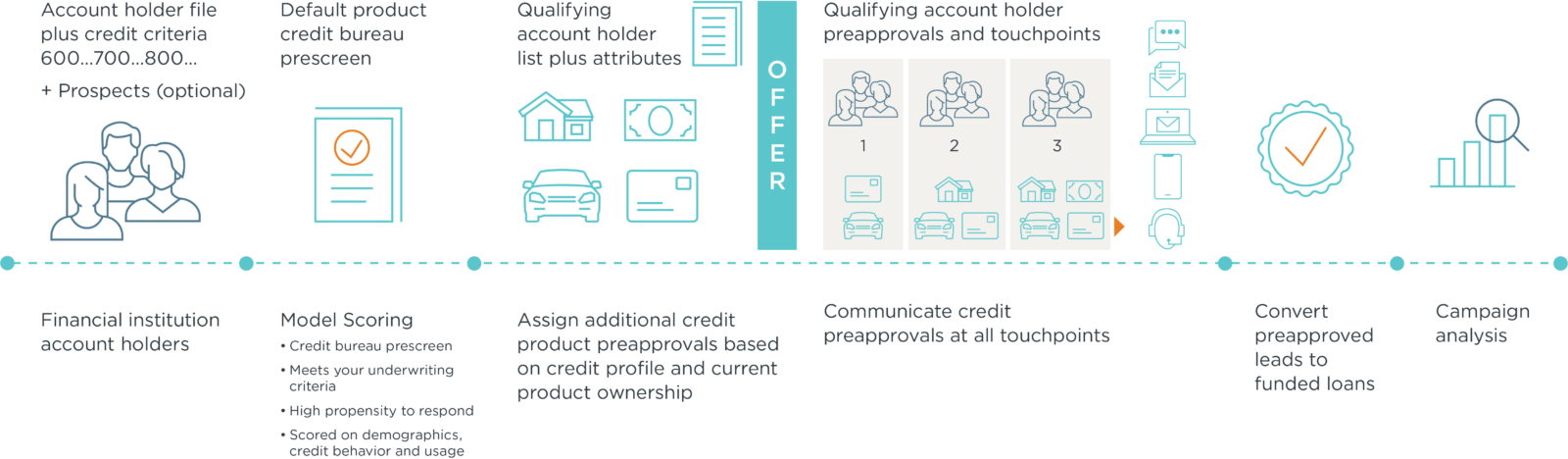

We make it possible to keep up with always on consumers. With Multi-Loan Pre-Approval you can continuously prescreen and match qualified candidates with unique personalized offers for home equity, auto, credit card and personal loans — all at once and across multiple channels. It’s easy for customers to access, review and accept multiple loan offers — anytime and anywhere, improving engagement and loyalty. With Vericast, you have the people, processes and resources to do more and at a lower cost per acquisition than traditional campaigns.

A Turnkey Solution Delivering Measurable Results

How it Works

EASY, ANXIETY-FREE CUSTOMER EXPERIENCES

Account holders can access, review and accept multiple prescreened loan offers at every touchpoint:

- Direct mail

- Online banking

- Mobile banking

- In-branch

Multi-Loan Pre-Approval also delivers unique online and mobile banking features which enhance the customer experience and encourage repeat use. Customers and prospects receive prescreened status alerts and can even run loan payment calculations from their smartphone or tablet, empowering them to make decisions in real time based on their unique needs.

Case Study

Turnkey Multi-Product Loan Marketing Solution Quickly Attracts Thousands of New Loans

You may also be interested in…