Today’s consumers have more control. They have more access, more choices, and more information to decide which offers are right for them.

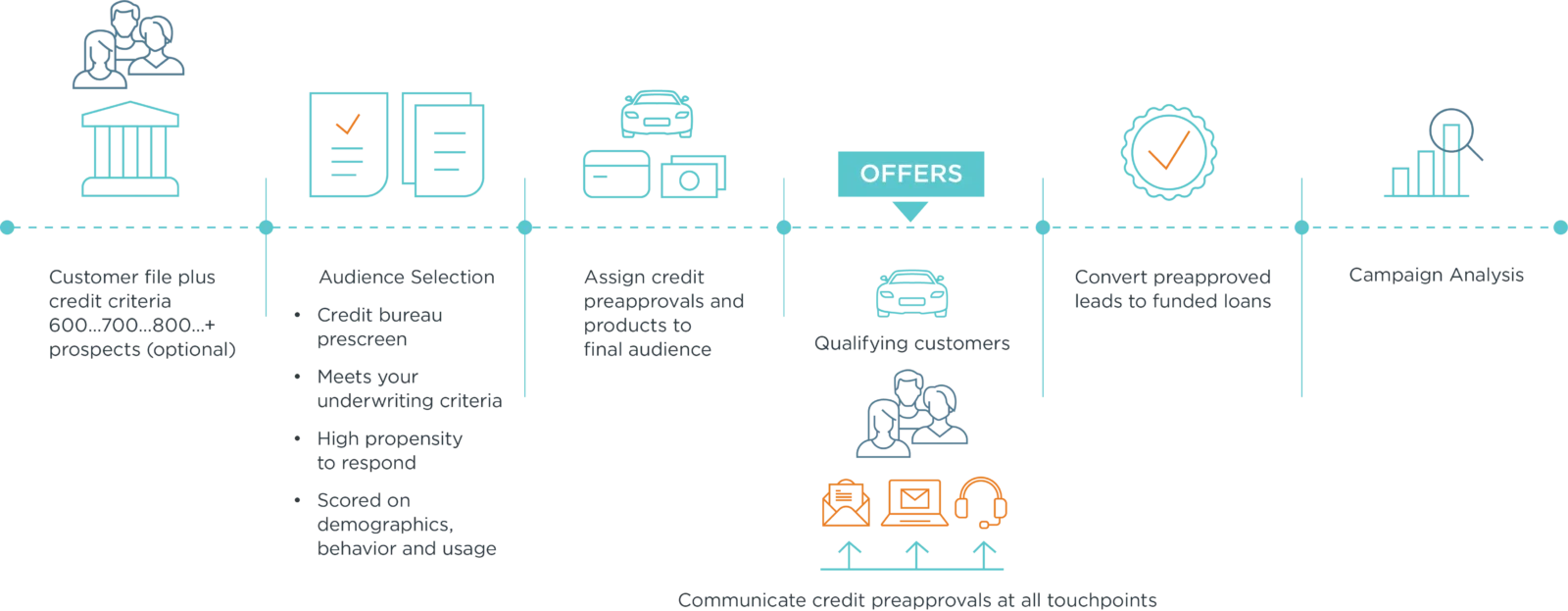

How it Works

Vying for attention is more difficult than ever. New competitors have created great disruption. Both traditional and non-traditional lenders have filled the marketplace with loans designed to tempt consumers by being fast, easy, and cheap.

Outdated marketing strategies no longer have the impact, produce the results, and create the differentiation needed to compete today. Data and analytics are the keys to competing. Financial institutions that use proactive, data-driven marketing strategies designed to perpetually engage prospects and customers across multiple channels, when they are most likely to purchase, are steps ahead in the purchasing process.

Single-Loan Pre-Approval uses dozens of data points or attributes to identify credit-qualified consumers to send pre-approved offers for mortgages, home equity, auto, credit card, and consumer loans at the time they are most ready to buy. Also included are loan refinance offers that highlight lower payments and potential savings. These personalized offers of savings are created using an individual’s current payment, loan balance and remaining term.

Features & Benefits

- Benefits for Customers

- Relevant loan offers that improve their lives

- Deeper relationship with an institution that understand their needs

- Offers with long-term savings and value

- Benefits for Financial Institutions

- Increased loan volume

- Lower cost per loan

- More qualified applicants using your credit and underwriting guidelines

- Analysis of results and optimization throughout the campaign

- Increased and improved brand awareness and perception

You may also be interested in…